Standard Deduction 2025 Married Filing Single. It's $3,100 per qualifying individual if you are married,. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2025. If you are 65 or older and blind, the extra standard deduction for 2025 is $3,900 if you are single or filing as head of household.

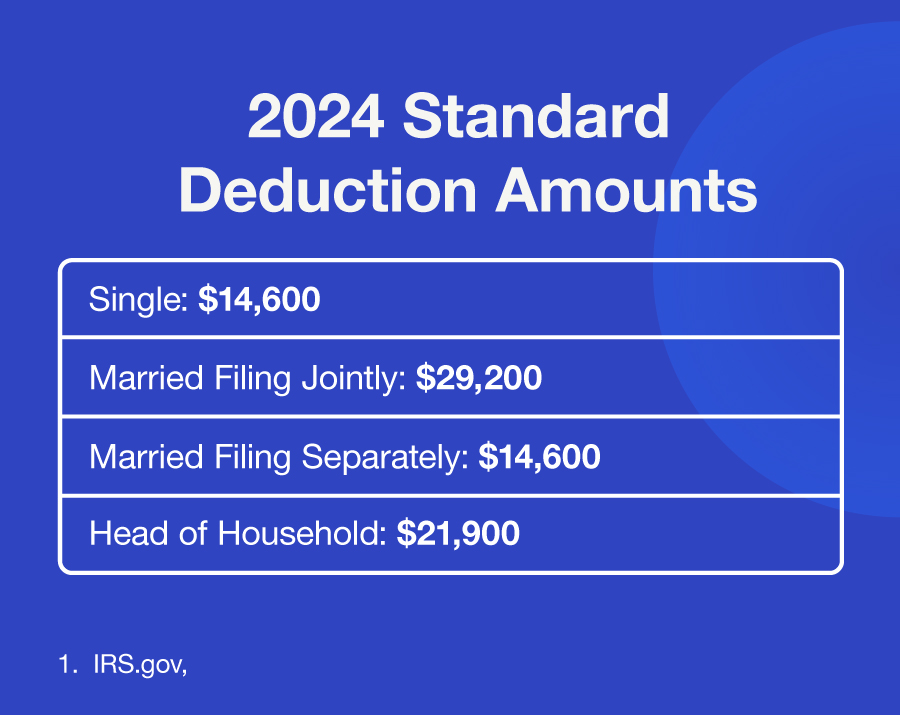

Standard Deduction For 2025 Single Student Ashlen Deirdre, The standard deduction for married couples filing jointly was $29,200 in 2025, while heads of household saw a $21,900 standard deduction in 2025.

Standard Deduction For 2025 Single Student Ashlen Deirdre, The standard deduction is the fixed amount the irs allows you to deduct from your annual income even if you don’t itemize your tax return.

What’s My 2025 Tax Bracket? Wisconsin Benefit Planning, People who are 65 or older can take an additional standard deduction of $1,950 for single and head of household filers and $1,550 for married filing jointly, married filing separately, and qualifying spouse filers.

Standard Deduction 2025 Married Filing Jointly 2025 Dion Myrtie, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

2025 Standard Tax Deduction Married Jointly Under 80c Katee Matilde, Tax year 2025 standard deduction amounts (filed in 2025) 2025 standard deduction amounts:

Standard Tax Deduction 2025 Single Over 65 Karen Merrili, The standard deduction lowers your adjustable gross income (agi) and the taxes you owe.

Irs 2025 Standard Deduction For Seniors Over 65 Bobbi Kevina, The standard deduction for couples filing jointly is $29,200 in 2025, up from $27,700 in the 2025 tax year.

2025 Tax Brackets and Other Adjustments Conner Ash, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2).